Adani Ports Secures ₹5,000 Crore Through Long-Term Debentures

Adani Ports Achieves Major Fundraising Milestone

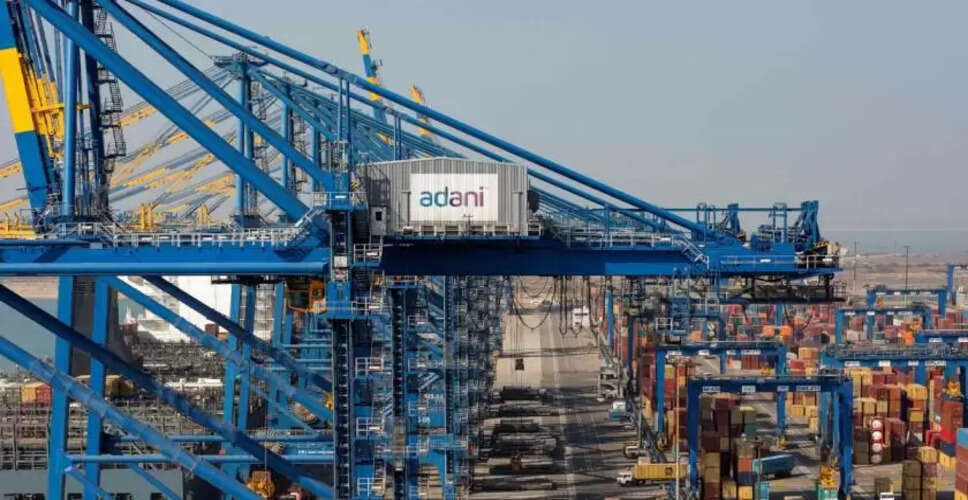

Adani Ports and Special Economic Zone Ltd (APSEZ), recognized as India's leading integrated transport utility, has successfully raised ₹5,000 crore via a 15-year Non-Convertible Debenture (NCD). This achievement is supported by APSEZ's robust financial standing and a 'AAA/Stable' domestic credit rating, allowing the issue to secure a competitive coupon rate of 7.75% per annum, fully subscribed by LIC. The debentures are set to be listed on the BSE.

This fundraising effort underscores APSEZ's strong access to long-term capital from various sources at favorable pricing, significantly improving its debt maturity profile. The transaction marks APSEZ's longest tenure issuance to date and one of the most extended in the history of Indian capital markets. The proceeds are intended to finance a proposed buyback of APSEZ's US Dollar bonds, pending board approval on May 31, 2025. A complete subscription would extend the average debt maturity from 4.8 years to 6.2 years.

“This initiative is not just a financing move; it represents a proactive implementation of a well-crafted Capital Management Plan for APSEZ, aimed at maintaining conservative leverage, extending the debt maturity profile, reducing costs, and diversifying funding sources. This strategy is designed to support APSEZ's long-term vision of becoming the world's largest integrated transport utility,” stated Mr. Ashwani Gupta, Whole-time Director & CEO of APSEZ.

Adani Ports aims to handle 1 billion tonnes of cargo by FY30, which is more than double the expected figure for FY25. In addition to its port operations, the company has ambitious plans to expand its logistics and marine sectors.

With improving debt repayment timelines and capital costs, APSEZ is positioned to access patient capital and enhanced liquidity, essential for long-term planning and large-scale projects. Furthermore, this provides financial flexibility for inorganic growth opportunities and allows for resource reallocation towards innovation, technology enhancements, and operational efficiencies.

Key Highlights

Key Takeaways

- APSEZ raises ₹5,000 crore through 15-year Non-Convertible Debentures (NCDs) from LIC.

- NCDs secured at a competitive coupon rate of 7.75% per annum; issued at par.

- Average debt maturity extends to 6.2 years from 4.8 years, reflecting APSEZ's Capital Management Plan.

- Demonstrates APSEZ's access to diverse financing sources and tenor in domestic markets.

- APSEZ retains its 'AAA/Stable' rating from leading domestic rating agencies—CRISIL, ICRA, CARE, and India Ratings.